IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Rs 100 crore (Base issue size) with a green shoe option of Rs 900 crore aggregating upto Rs 1000 crore. |

Download

|

|||||||||

Face Value |

Rs 1000 |

Download

|

|||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Redeemable , Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 18:00 |

||||||||||

IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Rs 100 crore (Base issue size) with a green shoe option of Rs 900 crore aggregating upto Rs 1000 crore. |

||||||||||

Face Value |

Rs 1000 |

||||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Redeemable , Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 18:00 |

||||||||||

*Allotment on first come first serve basis

ISSUE STRUCTURE |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Option/Series |

I |

II |

III |

IV |

V |

VI |

VII |

VIII |

|||

frequency of interest payments |

Annual |

Cumulative |

Monthly |

Annual |

Cumulative |

Monthly |

Annual |

Cumulative |

|||

Tenor |

36

|

36

|

60

|

60

|

60

|

84

|

84

|

84

|

|||

Coupon (% per annum) for Secured NCD Holders in all Categories |

8.25% |

NA |

8.20% |

8.50% |

NA |

8.43% |

8.75% |

NA |

|||

Effective Yield (% per annum) for Secured NCD Holders in all Categories |

8.24% |

8.25% |

8.51% |

8.50% |

8.50% |

8.76% |

8.74% |

8.75% |

|||

Redemption Amount ( secured NCD) on Maturity for Secured NCD Holders in all Categories |

1,000 |

1,268.80 |

1,000 |

1,000 |

1,504 |

1,000 |

1,000 |

1,799.75 |

|||

Why choose BondsIndia?

BondsIndia is an online platform for fixed-income securities such as IPOs, bonds, 54EC bonds, and fixed deposits. With a cumulative pedigree of 50+ years in the bond market, we aim to democratize the market for common investors by stationing detailed insights, expert advice, and keeping a close watch on the market sentiment. BondsIndia brings up-to-date information when IPOs go live, fixed deposits with higher interests, and bonds with competitive price before anyone else.

BondsIndia ditches the traditional ways of investing by offering a Technology based platform for investors that ensures instant online settlements and reduces counter-party risks. Choose BondsIndia for its sleek interface, fail-safe communication and step-by-step guide to ensure a well-placed bid. You can apply for India Infoline IPO on BondsIndia’s website.

Place your bid in three simple steps:

Key in Basic Details

Choose the IPO Series

Place the bid

How to invest in the IIFL Home Loan Limited?

Application process on BondsIndia platform is simple and seamless.

- Click on the details of the company on the home page

- Fill in the Application form with the basic details such as Name, email address, mobile number, Pan details, bank and Demat details

- Then, confirm the quantity and price and select payment method.

- That’s all folks , bidding complete!

Reach out to on info@bondsindia.com for more questions. Thank you for tuning in with BondsIndia.

Company Details

About the Issuer

- IIFL Home Finance Limited, a company incorporated under the Companies Act, 1956 (CIN:U65993MH2006PLC166475) and registered as a Housing Finance Company with the National Housing Bank vide Certificate of Registration (COR) No. 09.0175.18 dated September 25, 2018.

- The Company is a subsidiary of IIFL Finance Limited which is a NBFC registered with the Reserve Bank of India (RBI).

- Widespread Network :125+ Branches Across India, 2000+ Employees

- Products: Affordable Home Loan. Non Metro Housing Loan, Home Purchase, Home Renovation , Home Construction and Plot Purchase.

- AUM 14000 Cr+ , GNPA1.5% , NPA 1.00%, LTV 71%, Average Ticket Size 16 Lakhs, 99% Collection Efficiency ( Q4FY 21).

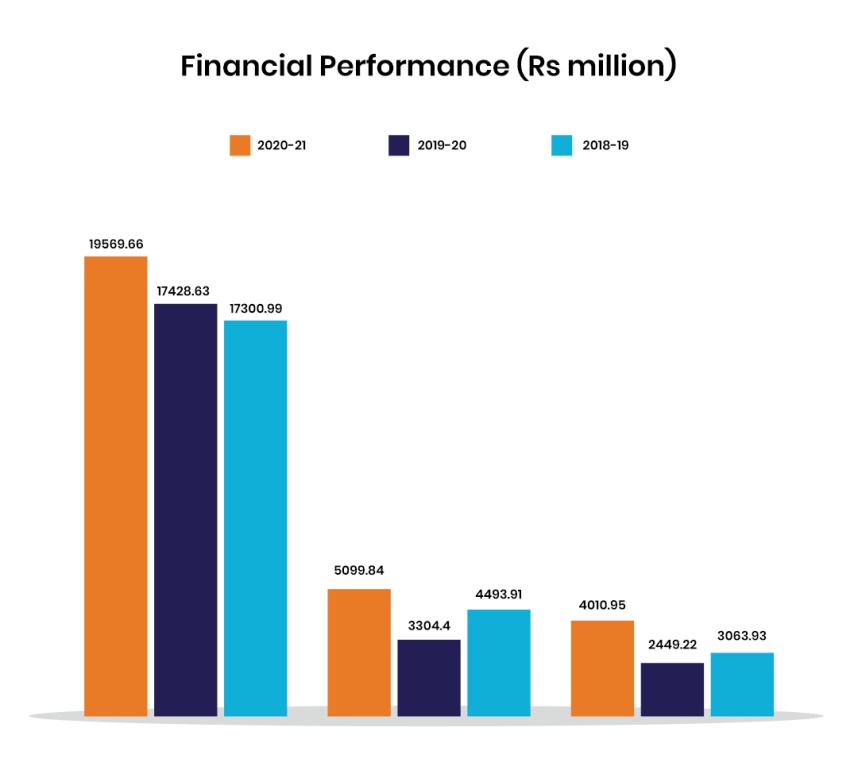

Company Financials

Key Strengths

-

Diversified business profile

A retail-focused NBFC with diversified products such as home loans, gold loans, microfinance loans (MFI), MSME business loans, LAP and construction finance.

-

Demonstrated ability to build significant

competitive positions across businesses

IIFL Finance has a diversified resource profile and has demonstrated its ability to raise funds through various sources. One of the key sources to raise funds are from assignment and securitisation constituting around 40% of the funding requirement.

-

Experienced Management and strong ownership

IIFL Finance Group is led by a qualified and experienced management team who possess strong experience in the financial services domain. The board of Directors are Mr. Nirmal Jain (the founder of IIFL Group and chairman of IIFL Finance Limited), Mr. R. Venkataraman (co-promoter and managing director of IIFL Finance Limited) and other independent directors. The parent company , IIFL Finance , is a listed company with strong shareholder background.

Credit Risks

-

Impact on asset quality due to Covid-19

Asset Credit Quality has been under pressure due the global pandemic in FY20 and FY21. There has been a increase in gross NPA from 1.96% in March 19 to 2.31% in March 20. The loan moratorium had also temporarily bought about a dip in collections.

-

Limited loan seasoning

IIFLs AUM has shown a steady growth from Rs 22281 cr in March 17 to Rs 42264 cr in Dec 20 . However the product mix is highly skewed towards Home Loan and Loan Against Property (LAP), exhibiting limited seasoning, which constitute around 45% of the total AUM.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.