IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Rs 100 crore (Base issue size) with an option to retain oversubscription upto Rs 900 crore aggregating upto Rs 1000 crore |

Download

|

|||||||||

Face Value |

Rs 1000 |

Download

|

|||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Rated , Redeemable , Listed Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 17:00 |

||||||||||

IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Rs 100 crore (Base issue size) with an option to retain oversubscription upto Rs 900 crore aggregating upto Rs 1000 crore |

||||||||||

Face Value |

Rs 1000 |

||||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Rated , Redeemable , Listed Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid timing(24 hour format) |

10:00 to 17:00 |

||||||||||

Why choose BondsIndia?

BondsIndia is an online platform for fixed-income securities such as IPOs, bonds, 54EC bonds, and fixed deposits. With a cumulative pedigree of 50+ years in the bond market, we aim to democratize the market for common investors by stationing detailed insights, expert advice, and keeping a close watch on the market sentiment. BondsIndia brings up-to-date information when IPOs go live, fixed deposits with higher interests, and bonds with competitive price before anyone else.

BondsIndia ditches the traditional ways of investing by offering a Technology based platform for investors that ensures instant online settlements and reduces counter-party risks. Choose BondsIndia for its sleek interface, fail-safe communication and step-by-step guide to ensure a well-placed bid. You can apply for India Infoline IPO on BondsIndia’s website.

Place your bid in three simple steps:

Key in Basic Details

Choose the IPO Series

Place the bid

How to invest in the IPO

Application process on BondsIndia platform is simple and seamless.

- Click on the details of the company on the home page

- Fill in the Application form with the basic details such as Name, email address, mobile number, Pan details, bank and Demat details

- Then, confirm the quantity and price and select payment method.

- That’s all folks , bidding complete!

Reach out to on info@bondsindia.com for more questions. Thank you for tuning in with BondsIndia.

Company Details

About the Issuer

- IIFL Finance Limited is one of the leading players in the financial services space in India. It mainly provides a diverse range of loans and mortgages.

- These include home loans, gold loans, business loans including loans against property and medium & small enterprise financing, micro finance, developer & construction finance and capital market finance; catering to both retail and corporate clients

- The company has a nationwide presence with a thriving network of 2,563 branches across 500+ cities.

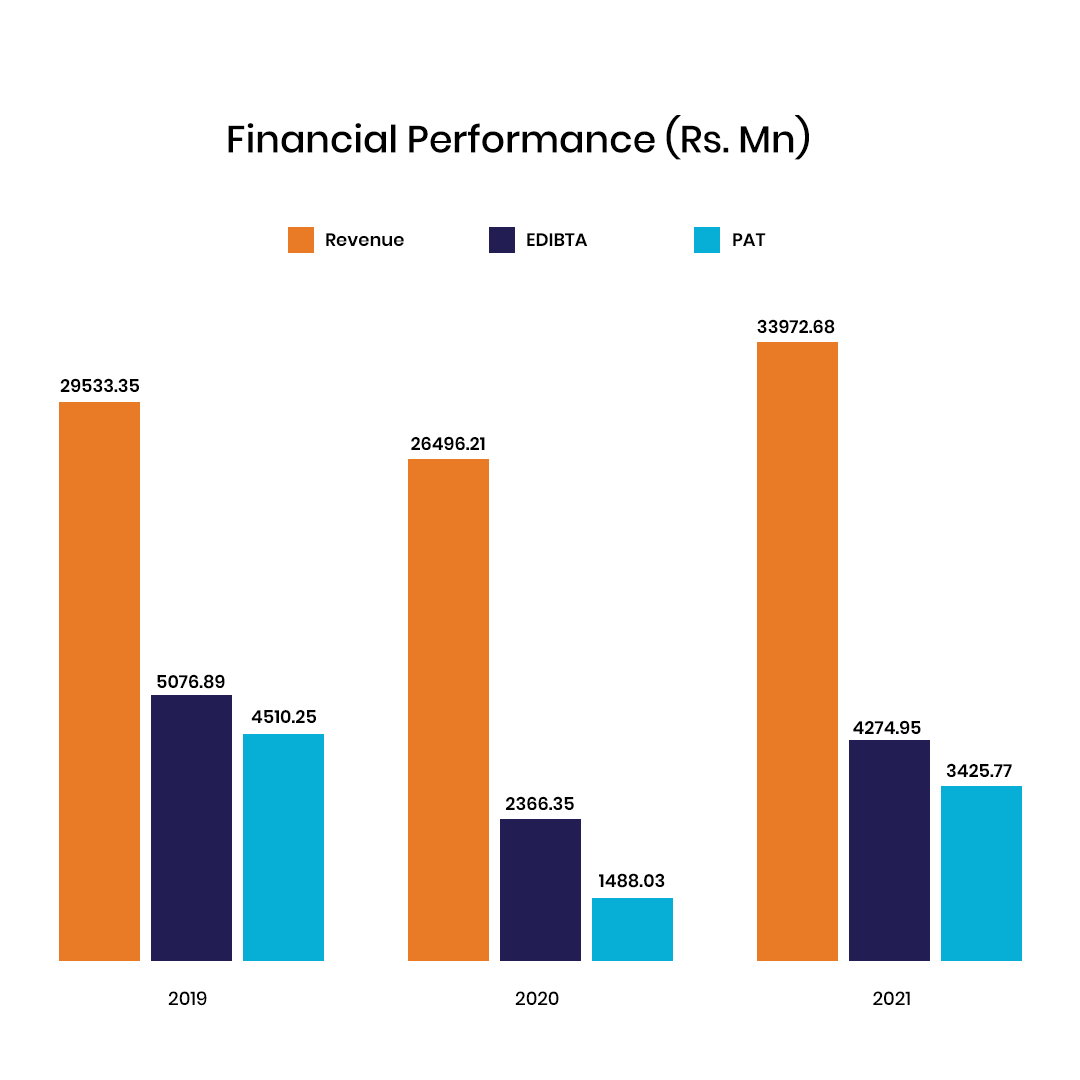

Company Financials

Key Strengths

-

Diversified retail lending portfolio with an

extensive branch network

The IIFL Finance group, having consolidated assets under management (AUM) of Rs 42,264 crore as on December 31, 2020 (Rs 37,951 crore as on March 31, 2020; Rs 34,904 crore as on March 31, 2019), is primarily engaged in secured lending across various retail asset classes. IIFL Finance has two lending subsidiaries, IIFL Home and Samasta, which carry out the mortgage finance and microfinance businesses, respectively.

Retail loans accounted for almost 90% of the AUM as on December 31, 2020, with a high level of granularity (loans of less than Rs 1 crore). Also, more than 40% of the portfolio qualifies under priority sector lending. The group had identified four key segments - home loans, business loans (including loan against property {LAP} and lending to micro small and medium enterprises—MSME), gold loans and microfinance, as key growth drivers over the medium term. -

Adequate capitalisation

The IIFL Finance group is adequately capitalised, with a consolidated networth of around Rs 5,233 crore as on December 31, 2020 (Rs 4,766 crore as on March 31, 2020). Networth coverage for net non-performing assets (NPAs) was comfortable at around 22 times as on December 31, 2020 (17 times as on March 31, 2020).The group has demonstrated its ability to raise capital from long-term marquee investors such as Fairfax and the CDC group (Rs 1000 crore raised from CDC in fiscal 2017). Also, the company has recently raised subordinated bonds to boost capitalization levels. Given the growth plans, capitalisation should remain adequate for the current scale of operations. However, the ability to raise capital and manage leverage levels over the medium term will be an important factor.

Credit Risks

-

Limited seasoning of some of the asset classes

like home loans and MSME loans

IIFL Finance group’s loan portfolio has grown at a CAGR of about 25% (last three years). Given the scale up of the loan book in recent years and entry into newer segments, the portfolio remains unseasoned and hence, overall asset quality is yet to be tested through cycles. While certain products have a shorter tenure, and hence, have seen a complete cycle, home loans and MSME lending have limited seasoning so far. Home loans are long tenure products and MSME lending is a recent addition to the product suite. Reported gross NPAs and net NPAs stood at 1.61% and 0.77%, respectively, as on December 31, 2020 (2.31% and 0.97%, respectively, as on March 31, 2020).Also, while increasing focus on small-ticket retail loans will benefit the inherent asset quality over the medium term, ability to underwrite and maintain strong credit practices across asset classes, amid stiff competition from established players, remains to be seen.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.