Incorporated on February 14, 2012, Navi Finserv Limited is an NBFC registered in India. The company’s NBFC license was effective on March 11, 2016. On March 05, 2022, the company was converted from a private limited company to a public company.

Navi Finserv offers personal loans and home loans under its brand name “Navi” to customers staying in different corners of the country. The company has a sound technical system and has a good hold in the market. It focuses on digital lending products and promotes personal and housing finance. Navi FinServ Limited IPOs have proved to be a good option to raise funds for the expansion of the company's products and services.

The Company aims to cover PAN India and emerge as one of the most trusted digital lending service providers. The team is in the process of upgrading the technology and digital lending system and processing. Navi FinServ Limited NCD IPOs have been receiving overwhelming responses from investors in India.

Why Choose Navi FinServ Limited NCD IPOs to Invest?

According to recent news, Navi Finserv debt bond got listed recently in 2022 followed 1.65 times subscription of the base issue of Rs. 300 crores. It received total bids worth Rs. 495.72 crores. It was about 65% higher than the base issue. The fintech firm's secured, rated, listed and redeemable Non-Convertible Debentures (NCDs) received good response. It had a total value of Rs. 600 crores that included the greenshoe option of Rs. 300 crores.

Some of the Navi FinServ bonds are rated as ‘A’ which relatively indicates medium risk. Considering the risk-reward ratio and the number of options available to invest in the secondary market, long-term investors can look into investing a very small portion of their fixed-income portfolio in the above NCD, and that too is only for diversified investment purposes.

Investing in Navi FinServ Limited NCD IPOs may seem attractive. You can take your decision of investing in the company after considering the essential deciding factors.

Latest Bonds

Latest Bonds

Latest IPOs

Issuer

Issue Size

Coupon

Open Date

Latest IPOs

An Overview of May 2022 Navi Finserv NCDs

The table here will help you learn about the company’s NCD issued in the month of May. The NCDs are known to have been successful. Investors have taken a keen interest in the NCDs and considered investing.

Below is the detail of Navi Finserv NCD May 2022

| Issue Open | May 23, 2022 - Jun 2, 2022 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Security Name | Navi Finserv Limited | ||||||||

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) | ||||||||

| Issue Size (Base) | Rs. 300.00 Crores | ||||||||

| Issue Size (Shelf) | Rs. 300.00 Crores | ||||||||

| Issue Price | Rs. 1000 per NCD | ||||||||

| Face Value | Rs. 1000 each NCD | ||||||||

| Minimum Lot Size | 10 NCDs | ||||||||

| Market Lot | 1 NCD | ||||||||

| Listing At | BSE, NSE | ||||||||

| Credit Rating | IND A/ Stable by India Ratings & Research Pvt Ltd | ||||||||

| Tenor | 18 and 27 Months | ||||||||

| Series | Series I to IV | ||||||||

| Payment Frequency | Monthly and annually | ||||||||

| Basis of Allotment | First Come First Serve Basis |

Understand About the Navi Finserv Housing Loans

You can consider reading about housing loans facilitated by the company. You will be able to learn about its features, the amount of loan you can seek, tenure, and more.

Navi Finserv Housing Loans are for

Navi Finserv Housing Loans Features

Navi Finserv Housing Loans are amidst the demanding company products. Customers have been showing more interest in it because of many reasons. The above information may help you in your decision.

FINANCIAL HIGHLIGHTS

Navi Finserv Limited Amount in Lakhs

| YEARS | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| TOTAL ASSETS | 41,403.30 | 3,32,107.53 | 3,68,523.54 | 12,248.62 | 11,583.94 |

| REVENUE | 4,598.93 | 3,367.36 | 7,522.74 | 1,614.46 | |

| PROFIT | -669.08 | 9,754.25 | 971.63 | 79.34 |

| Total Assets | Debt- Equity ratio | ROE ratio | Return on Assets |

|---|---|---|---|

| 41,403.30 | 11,852.62 | -5.72 | -1.79 |

What are the features of Navi Finserv Digital Personal Loans?

Personal loan today is one of the best mediums to meet your need or short-term or emergency funds. If you are planning to apply for personal loans, the following information may be of significant help.

Consider the above information about Navi Finserv Digital Personal Loans before you go for the loan application. It may help you avoid any kind of disappointment.

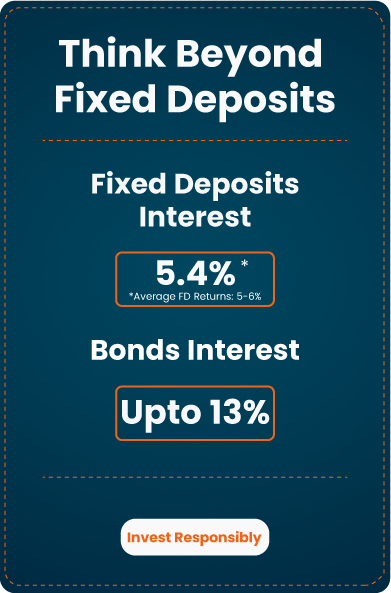

Key Advantages of Investing in Bonds

Bonds are a preferred investment avenue for risk-averse people. It helps take advantage of fixed returns, stable income, liquidity, and more.

➢ Bonds are a relatively safe and high-yielding investment product.

➢ Investors have the option to invest in long-term or short-term bonds.

➢ It is a fixed-income option.

➢ Some bonds offer the benefit of tax exemption on interest income.

➢ Trading in bonds is easy and hassle-free

Advantages

The company’s assets under management for loan business grew by 67% from Rs. 1,758.5 crores to Rs. 2,949.21 crores by March 2022. Also, for the quarter ending March 2022, the company's Net non-performing assets (NNPA) and Gross Non-Performing Assets (GNPA) stood at 0.9 and 0.04%, respectively.

Key Advantages with Navi Finserv Limited

- It is a non-deposit taking NBFC

- It is registered with RBI

- It is a wholly owned subsidiary of Navi Technologies Limited, a reputed brand in India

- The NCDs issued sometime back has been rated as IND A/ Stable by India Ratings & Research Pvt. Ltd.

- Navi NCD IPOs assure an adequate degree of safety to investors

If you are on the hunt for a company to park your surplus money in NCDs or bonds, you may consider Navi Finserv Limited NCD IPOs. The company may help you earn better yields and plan your investments in a better way.

Frequently Asked Questions

The company Navi Finserv was incorporated on February 14, 2012.

The Navi Finserv Product includes Digital Personal Loans, Housing Loans, and Loan against Property.

Navi Finserv Personal Loans have tenure that ranges up to 84 months.

You can get a personal loan up to Rs. 20, 00,000 subject to the fulfillment of the eligibility and necessary documentation.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.