Housing Development Finance Corporation (HDFC) was incorporated on October 17th, 1977, as a Public Limited Company. The Industrial Credit and Investment Corporation of India (ICICI) promoted the company. Today, it is a key player in housing finance in the country.

HDFC renders long-term home loans primarily to individuals in the low & middle-income categories and to corporate bodies. The organisation has also provided a good amount of money as construction finance to companies engaged in housing development businesses.

Based in Mumbai, India Housing Development Finance Corporation Limited (HDFC) is an Indian private financial institution. It serves customers countrywide through its different branches and associates. Today, it also has a strong presence in asset management, venture capital, banking, realty, education, deposits & education loans, and life and general insurance. If you are thinking to buy a Housing Development Finance Corporation Limited share, it can help you earn a decent return on investment.

Why Choose Housing Development Finance Corporation IPO to Invest?

Housing Development Finance Corporation (HDFC) since its inception has witnessed continued growth. The business expansion and increase in revenue have attracted investors from different segments. Today, it has many subsidiaries and associates. HDFC has a good shareholding in the different subsidiaries and associates.

The company floated Debenture, having ISIN number INE001A07TG4, with a face value of Rs. 10,00,000 on 01 Dec 21 to raise Rs. 10000 crores. The issue has the Maturity Date of 01 Dec 2031, a 7.05% coupon rate, and a CRISIL rating of AAA. The interest earned from the discussed Debenture will be paid annually. It successfully raised the required fund without much effort because of its good creditworthiness.

Investors may benefit from their decision of investing in Housing Development Finance Corporation IPO, Debentures, and Housing Development Finance Corporation shares.

Latest Bonds

Latest Bonds

Latest IPOs

Issuer

Issue Size

Coupon

Open Date

Latest IPOs

What are the different HDFC Products and services?

Housing Development Finance Corporation (HDFC) is in the market for years. It is a trusted brand in finance. People prefer it for many reasons. The product range and services are also key attractions for users.

The different HDFC Products and services include

➢ Mortgage

➢ Life insurance

➢ General insurance

➢ Mutual funds

HDFC in the country is one of the extensively sought and trusted companies engaged in serving customers with a wide range of financial and other products.

What are HDFC’s Major Subsidiaries and Associates?

Housing Development Finance Corporation over the time has grown beyond expectation. Today it is also known for its Subsidiaries and Associates.

➢ HDFC Bank Limited

➢ HDFC Standard Life Insurance Company Limited

➢ HDFC ERGO General Insurance Company Limited

➢ HDFC Asset Management Company Limited

➢ GRUH Finance

➢ HDFC Venture Capital Limited

➢ HDFC RED

➢ HDFC Sales Private Limited

➢ Credila Financial Services Private Limited

The above-listed Subsidiaries and Associates are among the well-known companies known to do well in the market. You can explore online to learn about each.

FINANCIAL HIGHLIGHTS

Housing Development Finance Corporation Limited Amount in CR

| YEARS | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| TOTAL ASSETS | 640,862 | 567,598 | 524,093 | 458,777 | 398,909 |

| REVENUE | 47,990 | 48,175 | 58,763 | 43,378 | 40,707 |

| PROFIT | 13,742 | 12,027 | 17,769 | 9,632 | 10,959 |

| Total Assets | Debt- Equity ratio | ROE ratio | Return on Assets |

|---|---|---|---|

| 640,862 | 4.16 | 11.42 | 2.14 |

What is the holding of HDFC in different companies?

HDFC is a reputed brand in the country well-known for its exclusive services. The company’s performance in the market is a key attraction for investors.

➢ HDFC holds 26.14% of shares in HDFC Bank

➢ HDFC holds approx. 51.7% of shares in HDFC Life

➢ HDFC holds approx. 57.4% of its shares in HDFC Asset Management Company

➢ HDFC holds a 50.5% share in HDFC ERGO General Insurance Company

The above-detailed information about the holding of HDFC in different companies. The shared information may help investors take better investment decisions.

Trading Online in Bonds at BondsIndia

BondsIndia is the only platform having its tech integration with The Indian Clearing Corporation Limited (ICCL) to provide Real-Time online KYC, reporting, and trade settlement facility.

We source bonds from MFs, NBFCs, and other large institutional investors for bond inventory, ensuring best- priced bonds available on our dedicated website www.bondsindia.com for retail participation.

BondsIndia is a large digital marketplace for fixed-income instruments, using pioneering tech integrations to provide investors seamless experience, starting from KYC processing to bond units getting transferred to their Demat account.

Advantages

Housing Development Finance Corporation Limited has a good reputation among customers and investors. Its stocks are known to perform well and benefit investors. According to the sources, HDFC’s Revenue in 2022 is 135,968 crore (US$17 billion) and the Operating income is Rs. 46,512 crores (US$5.8 billion).

Key Advantages with HDFC

- Advantage of creditworthiness

- A profit-making company

- Easy to Invest

- Multiple options to invest in Housing Development Finance Corporation stocks

- Steady returns

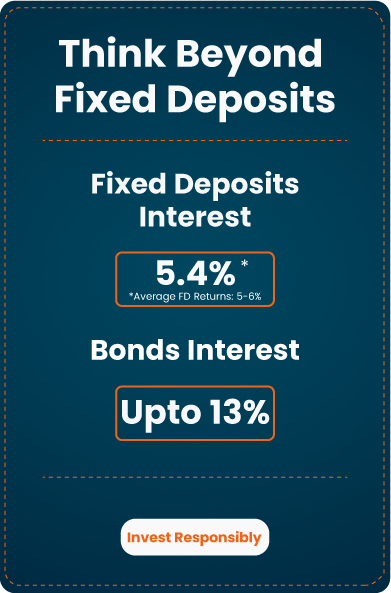

- Relatively better returns on investment

- The benefit of HDFC-HDFC Bank merger for investors

Housing Development Finance Corporation thus is seen as a stable company doing well. Investors are found reaping the fruit of their decision related to investment in HDFC stocks or bonds. Visit the company website for detailed information about HDFC!

Frequently Asked Questions

HDFC Bank for the first time launched its IPO in March 1995. The Initial Public Offering was valued at 500 million.

The key business areas of HDFC bank are wholesale banking, retail banking, and treasury operations.

Housing Development Finance Corporation Ltd.’s quote is equal to INR 2674.950 on 2022-12-05. A long-term increase is expected in the "HDFC" stock price based on our forecasts for 2027-11-26 to INR 3550.040. The revenue with a 5-year investment is expected to be around +32.71%.

Investing in Housing Development Finance Corporation Limited bonds can be a good choice. But invest only after considering your investment needs and different essential deciding factors.

The awards and recognitions include a #561 rank (May 2013) in the Forbes list of the Global 2000 list of largest companies and a joint study by The Economic Times and 'The Great Place to Work Institute' recognised HDFC Limited as one of India's 'Best Companies to work for' in 2012.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.