Fullerton India Credit Company Limited (FICC) is a non-banking financial company (NBFC) engaged in serving clients at different locations. The company is known to perform well since its inception. Investors from different sections of society have benefitted from its performance in the market. The company focuses primarily on individuals and small businesses (MSMEs). FICC provides credit-based solutions to customers' needs.

Fullerton India Credit Company Ltd NCD IPOs have been receiving good responses from investors. The company sometime back raised Rs. 750 crores from its parent company Fullerton Financial Holdings. This raised capital was to help Fullerton India to expand its reach and cater to the need of valuable individuals and small businesses (MSMEs) on flexible terms.

Fullerton India Credit Company Ltd's IPOs were rated AAA by Crisil, ICRA, and Care. The company is a customer-focused organisation and is in the constant process of business expansion.

Why Choose Fullerton India Credit Company Ltd NCD IPO to Invest?

Fullerton India Credit Company Ltd NCD IPOs are among the demanding investment options. The creditworthiness and good ratings have won the trust of investors from different segments. Today, it is a brand in the industry and a recognised NBFC in India.

The company's authorised capital is INR 250000.0 lakhs. It has 79.20286% paid-up capital which is INR 198007.15 lakhs.

Fullerton India Credit Company Limited's last annual general meet (AGM) took place on 06 Jul 2018. As per the Ministry of Corporate Affairs (MCA), the company last updated its financials on 31 Mar 2018. Buying Fullerton India Credit Company Ltd Bonds may prove to be a wise decision for risk-averse investors.

Latest Bonds

Latest Bonds

Latest IPOs

Issuer

Issue Size

Coupon

Open Date

Latest IPOs

An Overview of Fullerton India Credit Company Limited

The below table will give you an overview of the company. You can get information about its incorporation date, company type, paid-up capital, and more.

| CIN | U65191TN1994PLC079235 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Date of Incorporation | 30 Aug 1994 | ||||||||

| Status | Active | ||||||||

| Company Category | Company limited by Shares | ||||||||

| Company Sub-category | Non-govt company | ||||||||

| Company Class | Public | ||||||||

| Authorized Capital | 250000.0 lakhs | ||||||||

| Paid-up Capital | 198007.15 lakhs | ||||||||

| Paid-up Capital % | 79.20286 | ||||||||

| Registrar Office City | Chennai | ||||||||

| Registration Number | 79235 | ||||||||

| Listing Status | Unlisted | ||||||||

| AGM last held on | 06 Jul 2018 | ||||||||

| Balance Sheet last updated on | 31 Mar 2018 |

Know About the company board members & directors

The board members and directors play a vital role in the success of an organisation. They generally carry rich experience, and knowledge, and have a track of many successful projects in their portfolio.

The Current board members & directors in the company include the following names

Fullerton India is headed by the dynamic leader Mr. Shantanu Mitra. He is the Chief Executive Officer & Managing Director responsible for covering Risk, Technology, Analytics, Operations, and Digital Initiatives. He is also responsible for the overall corporate strategy of the company and its subsidiaries.

FINANCIAL HIGHLIGHTS

THDC INDIA LIMITED Amount in CR

| YEARS | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| TOTAL ASSETS | 23,49,045 | 2,378,248 | 2,916,817 | 23,97,507 | 1,790,165 |

| REVENUE | 3,59,083 | 475,786 | 528,850 | 4,13,812 | 274,903 |

| PROFIT | 5,802 | 2-115,732 | 74,728 | 77,522 | 35,435 |

| Total Assets | Debt- Equity ratio | Net worth | Net profit margin |

|---|---|---|---|

| 23,49,045 | 3.8 | 1.4 | 0.3 |

How can I invest in Fullerton India Credit Company Ltd Bonds?

Investing in Fullerton India Credit Company Ltd Bonds is simple and swift. You can visit bondsindia.com to check the availability of the company bonds and for related information. Alternatively, you can explore the company’s official website for more details on the company’s bonds and upcoming IPOs.

How can I expand my understanding about bonds?

Take a product tour to understand better Bonds, Types of Bonds, IPO, and other investment products available in the Indian market.

We at BondsIndia wish to provide our valued users/investors with exceptional investment experience using our cutting-edge technology.

Visit BondsIndia to take the PRODUCT TOUR Now!

Advantages

Fullerton India Credit Company Ltd IPOs are awaited by many investors also with a low-risk appetite. The company's authorised capital of Rs. 250000.0 lakhs and paid-up capital of Rs 198007.15 lakhs is evidence of the company's good performance in the market.

Key Advantages with Fullerton India Credit Company Ltd NCD IPOs

- A non-govt company limited by Shares

- Authorized Capital 250000.0 lakhs

- NBFC Fullerton India enables EMI payment through Paytm

- Has worthy creditworthiness

- Fullerton India Credit Company Ltd NCD IPOs can be an ideal investment option

Visitors can explore a host of products and services offered by Fullerton India. The company has been serving users for more than a decade. The awards and recognitions achieved by the company is the evidence of the company’s commitment to its customers coming from different walks of life.

Frequently Asked Questions

Fullerton India Credit Company Limited was incorporated on 30 Aug 1994.

It is a public unlisted company. It is classified as a company limited by shares.

Investors buying U GRO Capital April 2022 NCDs had the option to choose the investment tenor from 18, 27, and 36 Months.

U GRO Capital Limited was earlier known as Chokhani Securities. It is a BSE-listed NBFC that was established in the year 1993.

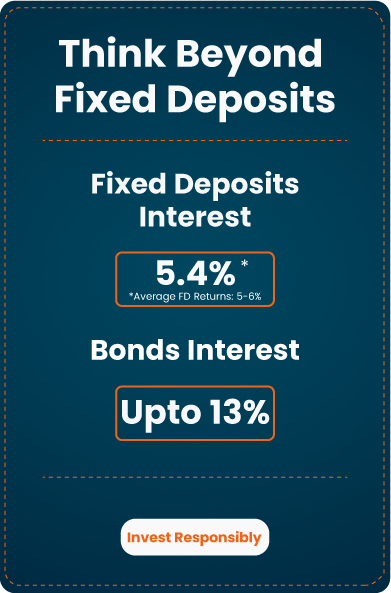

NCDs in comparison to fixed deposits are more liquid and are known to offer more returns. NCDs can be traded in the secondary market after they are listed on the stock exchange.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.