IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Rs 100 crore (Base issue size) with an option to retain oversubscription upto Rs 400 crore aggregating upto Rs 500 crore |

Download

|

|||||||||

Face Value |

Rs 1000 |

Download

|

|||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Rated , Redeemable , Listed Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 18:00 |

||||||||||

IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Rs 100 crore (Base issue size) with an option to retain oversubscription upto Rs 400 crore aggregating upto Rs 500 crore |

||||||||||

Face Value |

Rs 1000 |

||||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Rated , Redeemable , Listed Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid timing(24 hour format) |

10:00 to 18:00 |

||||||||||

Why choose BondsIndia?

BondsIndia is an online platform for fixed-income securities such as IPOs, bonds, 54EC bonds, and fixed deposits. With a cumulative pedigree of 50+ years in the bond market, we aim to democratize the market for common investors by stationing detailed insights, expert advice, and keeping a close watch on the market sentiment. BondsIndia brings up-to-date information when IPOs go live, fixed deposits with higher interests, and bonds with competitive price before anyone else.

BondsIndia ditches the traditional ways of investing by offering a Technology based platform for investors that ensures instant online settlements and reduces counter-party risks. Choose BondsIndia for its sleek interface, fail-safe communication and step-by-step guide to ensure a well-placed bid. You can apply for India Infoline IPO on BondsIndia’s website.

Place your bid in three simple steps:

Key in Basic Details

Choose the IPO Series

Place the bid

How to invest in the IPO

Application process on BondsIndia platform is simple and seamless.

- Click on the details of the company on the home page

- Fill in the Application form with the basic details such as Name, email address, mobile number, Pan details, bank and Demat details

- Then, confirm the quantity and price and select payment method.

- That’s all folks , bidding complete!

Reach out to on info@bondsindia.com for more questions. Thank you for tuning in with BondsIndia.

Company Details

About the Issuer

- JM Financial Products Limited is a Systematically Important Non-Deposit Taking NBFC (NBFC-ND-SI) registered with the Reserve Bank of India.

- They are focused on offering a broad suite of loan products which are customised to suit the needs of the corporates, SMEs and individuals.

- Business Verticals : Capital Market Financing , Retail Mortgage Financing , Structured Financing , Financial Institution Financing , Real Estate Financing.

- The Group is headquartered in Mumbai and has a presence across 518 locations spread across 166 cities in India

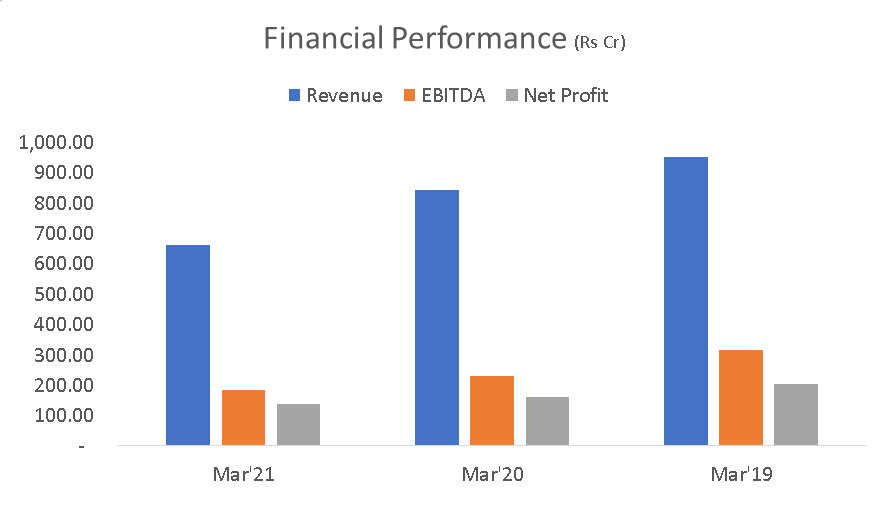

Company Financials

Key Strengths

-

Healthy capitalisation

The overall wholesale segment is facing challenges on account of funding constraint and lack of demand which makes the segment vulnerable to slippages in asset quality. Since the company maintains healthy capitalisation, it inherently provides cushion against the asset-side risk. Capitalisation is supported in the form of fresh equity as well as healthy accruals to net worth.

-

Established market position across its businesses

The group has developed a strong franchise in key operating segments such as investment banking, wealth management, and securities-based lending. This is aided by the track record and reputation of its experienced management and healthy client relationship. Furthermore, management has been conservative in its risk philosophy. The group has strong network of borrowers with whom they have long relationship and has never faced any asset quality issues. Over the years the company has strengthened its risk department

-

Diversified business model and comfortable

earnings profile

The group's earnings remain comfortable, with total revenue of Rs 2,386 crore and a profit of Rs 413 crore for first nine months of fiscal 2021. The group benefits from greater diversification of the business profile over the past few years and this has given stability to its earnings profile. The group has grown its investment banking, wealth management and securities business and mortgage lending business and it constituted around 48% and 37% of total revenue, respectively, for the quarter ended December 31, 2020.

Credit Risks

-

Asset quality in the wholesale lending business

remains inherently vulnerable; albeit risk

management processes are comfortable

At a sectoral level, what has supported the asset quality metrics of wholesale non-banks in the past has been the ability of the entity to get timely repayments/exits via refinancing or event-linked fund inflows. However, the current challenging funding environment has significantly increased refinancing risks especially for real estate players.

-

Potential funding challenges for

wholesale-oriented non-banks

JM Financial group has managed to raise long term funds aggregating over Rs 3,700 crores in FY20 and over Rs 1762 Crores from April till December 2020 for FY21. The funds raised has been through diversified sources including Commercial papers, Non-Convertible Debentures, Inter Corporate Deposit and Bank loan with improving cost of borrowings. During this period the company has also managed to diversify its investor base by raising money through retail investors, insurance companies and mutual funds.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.