IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Rs 200 crore (Base issue size) with an option to retain oversubscription upto Rs 800 crore aggregating upto Rs 1000 crore |

Download

|

|||||||||

Face Value |

Rs 1000 |

Download

|

|||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured, Redeemable, Listed Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 18:00 |

||||||||||

IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Rs 200 crore (Base issue size) with an option to retain oversubscription upto Rs 800 crore aggregating upto Rs 1000 crore |

||||||||||

Face Value |

Rs 1000 |

||||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Redeemable , Listed Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 18:00 |

||||||||||

Coupon Rate for Different type of Investor |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Tenor |

26 Months |

26 Months |

36 Months |

60 Months |

120 Months |

||||||

Type of NCD |

Secured |

Secured |

Secured |

Secured |

Secured |

||||||

Frequent of Interest Payment |

Annual |

Cumulative |

Annual |

Annual |

Annual |

||||||

Series |

I |

II |

III |

IV |

V |

||||||

Coupon (% per annum) for Category 1 & II |

8.10% |

NA |

8.25% |

8.50% |

8.75% |

||||||

Coupon (% per annum) for Category Ill & IV |

8.35% |

NA |

8.50% |

8.75% |

9.00% |

||||||

Effective Yield (% per annum) for Category | & II |

8.12% |

8.10% |

8.24% |

8.50% |

8.74% |

||||||

Effective Yield (% per annum) for Category Ill & IV |

8.37% |

8.35% |

8.49% |

8.75% |

8.99% |

||||||

About BondsIndia

BondsIndia is an online platform for fixed-income securities such as IPOs, bonds, 54EC bonds, and fixed deposits. With a cumulative pedigree of 50+ years in the bond market, we aim to democratize the market for common investors by stationing detailed insights, expert advice, and keeping a close watch on the market sentiment. BondsIndia brings up-to-date information when IPOs go live, fixed deposits with higher interests, and bonds with competitive price before anyone else.

We ditch the traditional ways of investing by offering a Technology based platform for investors that ensures instant online settlements and reduces counter-party risks. Choose BondsIndia for its sleek interface, fail-safe communication and step-by-step guide to ensure a well-placed bid. You can apply for Piramal Capital IPO on BondsIndia’s website.

Place your bid in three simple steps:

Enter your Basic Details

Choose the IPO Series

Place the bid

How to invest in the IPO

Application process on BondsIndia platform is simple and seamless.

- Fill in the Application form with the basic details such as name, email address, mobile number, Pan details, bank and Demat details.

- Then, confirm the quantity and price and select the payment method.

- Your bidding is complete.

Company Details

About the Issuer

- Piramal Capital & Housing Finance (PCHF), a wholly owned subsidiary of Piramal Enterprises Limited, is a registered housing finance company with National Housing Bank (NHB) and engaged in various financial services businesses.

- It provides retail and wholesale funding opportunities to its clients across sector.

- Products : Housing Loan (Home Loan, Construction Loan, Home Renovation Loan, Balance Transfer), Business Loan (Loan against property, Secured Business Loan), and Corporate (Real estate financing).

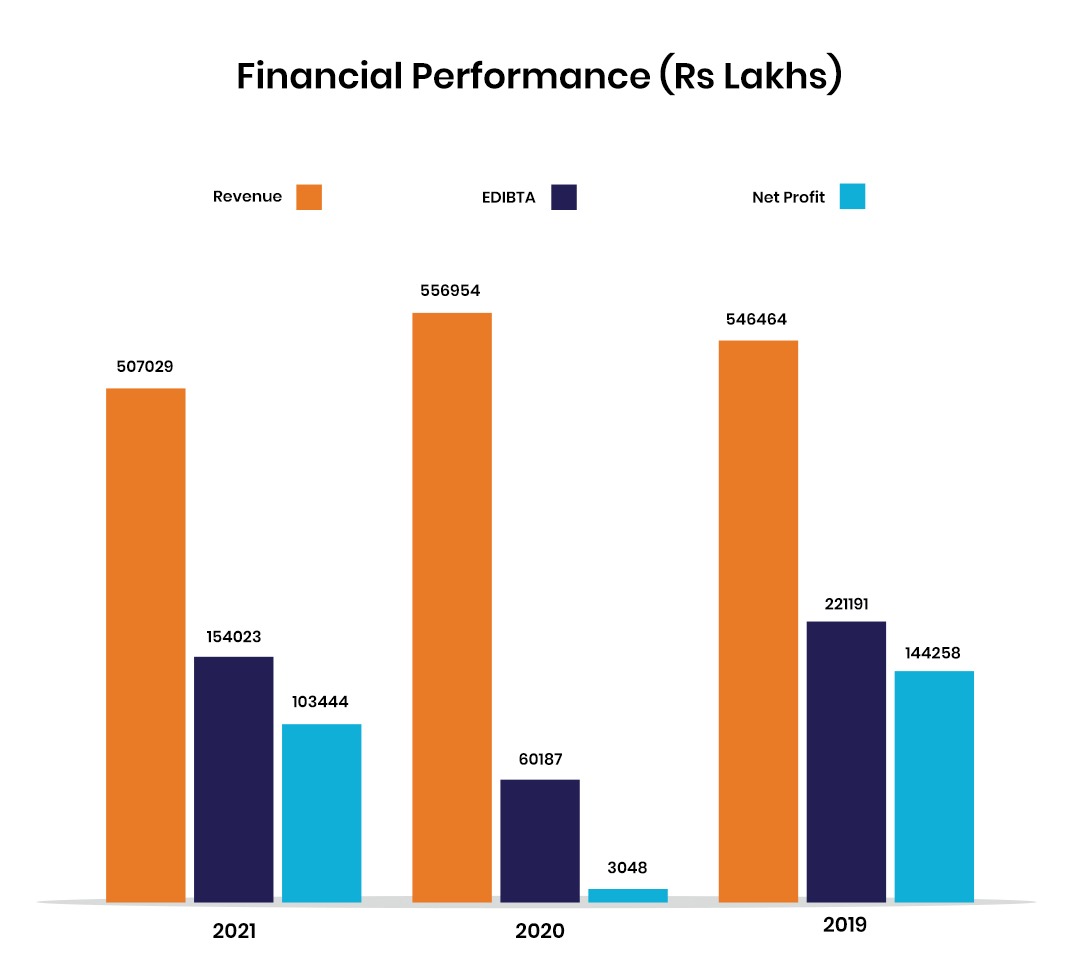

Company Financials

Key Strengths

-

Domain expertise and financial flexibility as a

part of Piramal Group

The company draws strength from the parent company, given its technical knowledge in the real estate private equity investor activity, development space and advisory services. Due to the long-standing experience of the parent company, PCHF leverages the large network of developers with relationships built over a period of time.

-

Adequate capitalisation supported by capital

infusion from the parent

The parent company has been regularly supporting the PCHF by capital infusion. In the financial year 2020, Piramal has raised Rs 14500 crores of equity funds through a mix of avenues like dis-investments of investments and non-core business, preferential share issue, out of which Rs 3700 crores have been infused in PCHF.

-

Experienced management team

The experienced management team has helped scale up the business. The team consists of seasoned industry professionals with prior experience in retail lending.

Credit Risks

-

High sectoral and client concentration risks;

slower-than-expected loan book diversification

The company loan book is skewed towards the risky real estate sector with a declining trend. Though the company has been diversifying its loan book over the past three years through its foray into new segments like housing finance and emerging corporate lending (ECL), the progress has been slower than expected due to the ongoing global pandemic

-

Fund-raising challenges for wholesale-oriented

non-bank financiers impacting business

While a sizeable quantum of funds has been raised (Rs 13500 in FY20), the cost of funds has increased since the September 2018 crisis. The company ability to raise long term funding at adequate rate would remain critical

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.