IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Base Issue of Rs.200 Crs with option to oversubscription up to Rs. 800 Crs aggregating to Rs. 1000 Crs. |

Download

|

|||||||||

Face Value |

Rs.1000 per NCD |

Download

|

|||||||||

Minimum no of Bonds |

Rs. 10,000(10 NCDs) |

||||||||||

Lot Size (Multiplier) |

1 Debenture (“Market Lot”) |

||||||||||

Nature of Instrument |

Secured NCDs & Unsecured NCDs |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 17:00 |

||||||||||

IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Base Issue of Rs.200 Crs with option to oversubscription up to Rs. 800 Crs aggregating to Rs. 1000 Crs. |

||||||||||

Face Value |

Rs.1000 per NCD |

||||||||||

Minimum no of Bonds |

Rs. 10,000(10 NCDs) |

||||||||||

Lot Size (Multiplier) |

1 Debenture (“Market Lot”) |

||||||||||

Nature of Instrument |

Secured NCDs & Unsecured NCDs |

||||||||||

Listing |

To be listed on BSE and NSE |

||||||||||

Exchange Bid timing(24 hour format) |

10:00 to 17:00 |

||||||||||

Coupon Rate for Different type of Investor |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Tenor |

24 Months |

24 Months |

24 Months |

36 Months |

36 Months |

36 Months |

60 Months |

60 Months |

87 Months |

87 Months |

|

Type of NCD |

Secured |

Secured |

Secured |

Secured |

Secured |

Secured |

Secured |

Secured |

Unsecured |

Unsecured |

|

Frequent of Interest Payment |

Annual |

Cumulative |

Monthly |

Annual |

Cumulative |

Monthly |

Annual |

Monthly |

Annual |

Monthly |

|

Series |

I |

II |

III |

IV |

V |

VI |

VII |

VIII |

IX |

X |

|

Coupon (% per annum) for Category 1 & II |

8.35% |

NA |

8.05% |

8.50% |

NA |

8.20% |

8.75% |

8.43% |

9.25% |

8.89% |

|

Effective Yield (% per annum) for Category | & II |

8.35% |

8.35% |

8.35% |

8.50% |

8.50% |

8.50% |

8.75% |

8.75% |

9.25% |

9.25% |

|

Effective Yield (% per annum) for Category Ill & IV |

8.75% |

8.75% |

8.75% |

9.00% |

9.00% |

9.00% |

9.25% |

9.25% |

9.75% |

9.75% |

|

Why choose BondsIndia?

BondsIndia is an online platform for fixed-income securities such as IPOs, bonds, 54EC bonds, and fixed deposits. With a cumulative pedigree of 50+ years in the bond market, we aim to democratize the market for common investors by stationing detailed insights, expert advice, and keeping a close watch on the market sentiment. BondsIndia brings up-to-date information when IPOs go live, fixed deposits with higher interests, and bonds with competitive price before anyone else.

BondsIndia ditches the traditional ways of investing by offering a Technology based platform for investors that ensures instant online settlements and reduces counter-party risks. Choose BondsIndia for its sleek interface, fail-safe communication and step-by-step guide to ensure a well-placed bid. You can apply for India Infoline IPO on BondsIndia’s website.

Place your bid in three simple steps:

Key in Basic Details

Choose the IPO Series

Place the bid

How to invest in the Indiabulls Housing Finance Limited ?

Application process on BondsIndia platform is simple and seamless.

- Click on the details of the company on the home page

- Fill in the Application form with the basic details such as Name, email address, mobile number, Pan details, bank and Demat details

- Then, confirm the quantity and price and select payment method.

- That’s all folks , bidding complete!

Reach out to on info@bondsindia.com for more questions. Thank you for tuning in with BondsIndia.

Company Details

About the Issuer

- Indiabulls Housing Finance Ltd. (IBHFL) is India`s third largest housing finance company, regulated by the Reserve Bank of India (RBI). IBHFL is rated `AA` by leading rating agencies including CRISIL, ICRA and CARE Ratings and at `AA+` by Brickwork Ratings. The company has a balance sheet size of Rs 0.87 trillion as on 30th June, 2021. The company has serviced more than 1 million happy customers and cumulatively disbursed loans of over Rs 2.86 trillion. It is has a strong nationwide presence and continues to reach out further with eHome Loans - India`s first completely online home loan fulfilment platform.IBHFL offers quick, convenient and competitively priced home loans in the affordable housing segment. The company`s primary goal is to ensure a superior home buying experience to its customers and to make housing finance more affordable and viable by contributing to the ecosystem that supports it

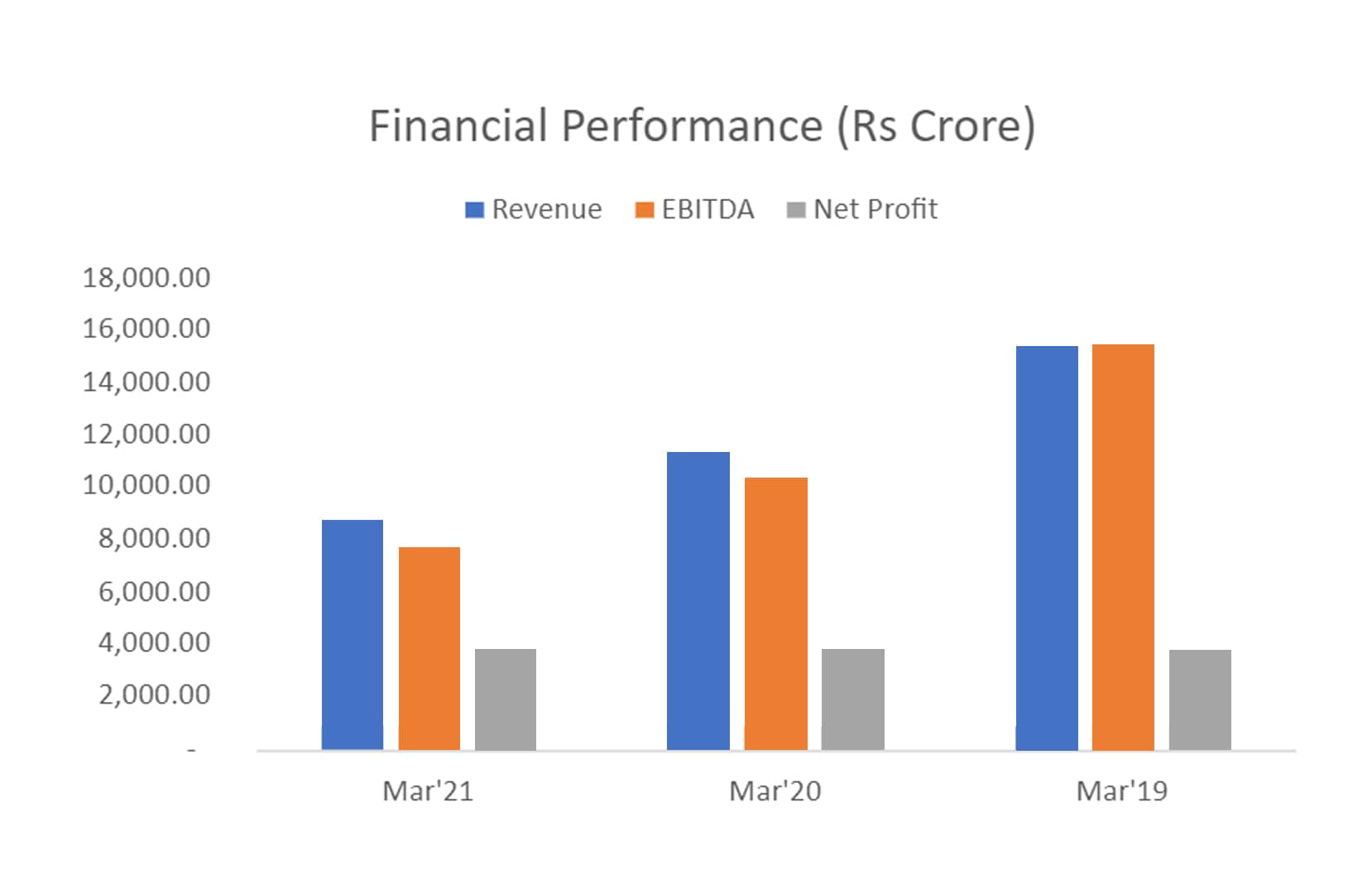

Company Financials

Key Strengths

-

Strong capitalisation, with healthy cover for

asset-side risks:

Capitalisation is marked by sizeable networth of Rs 16,302 crore as on December 31, 2020, supported by healthy internal accruals. Networth coverage for pro-forma net NPAs was also comfortable at around 13 times. Consolidated Tier-1 capital adequacy ratio (CAR) was healthy at 23.7% as on December 31, 2020, as was total CAR at 30.5%. Consolidated on-book gearing was comfortable at 4.0 times as on December 31, 2020 (4.9 times as on March 31, 2020). Given the strong liquidity that IBHFL maintains on a steady-state basis, net gearing was 3.3 times as on December 31, 2020.

-

Comfortable asset quality in retail segments:

IBHFL reported gross NPA of 1.75% as on December 31, 2020 compared to 1.84% as on March 31, 2020. Excluding the impact of the Supreme Court order on stay on NPA recognition, pro-forma gross NPA was at 2.44% as on December 31, 2020. Accelerated write-offs, primarily in the commercial credit portfolio, also supported the asset quality metrics during the current fiscal.

-

Sizeable presence in the retail mortgage finance

segment:

IBHFL is the one of the larger housing finance companies (HFCs) in India with total AUM of Rs 86,566 crore as on December 31, 2020. The share of housing loans within the overall AUM continues to increase – the same has risen to 68% as on December 31, 2020, from 50% as on March 31, 2015. The company’s LAP portfolio accounted for 19% of the overall AUM as on December 31, 2020, with remaining 13% was towards commercial credit. Going forward, the proportion of housing loan and LAP is expected to increase further from current levels.

Credit Risks

-

Susceptibility to asset quality risks arising from

the commercial real estate portfolio:

Asset-quality risks arising from a sizeable large-ticket commercial credit portfolio of Rs 11,340 crore as on December 31, 2020 persist, and could impact the company’s portfolio performance. Given the chunkiness of loans (average ticket size of Rs 150 crore), even a few large accounts experiencing stress could impact asset quality

-

Successful transition to new business model to be

established; though IBHFL has demonstrated strong

execution capabilities in the past:

The management has recalibrated their business model in light of funding access challenges that the company, as well as non-banking financial companies (NBFCs) in general have faced in recent times. Under the revised business model IBHFL plans to move towards a less risky and asset-light framework, wherein disbursements will primarily be in the housing loans and LAP segments (with potentially 60:40 split), with a low proportion of incremental disbursals in developer finance portfolio. Furthermore, on a steady state basis, of the overall disbursals, a significant proportion will be either co-originated or sold-down to banks.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.