IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Base Issue size of ₹ 200 Crore with an option to

retain oversubscription up to

|

Download

|

|||||||||

Face Value |

Rs 1000 |

Download

|

|||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Redeemable , Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 17:00 |

||||||||||

IPO Details |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Issue Size |

Base Issue size of

|

||||||||||

Face Value |

Rs 1000 |

||||||||||

Minimum no of Bonds |

10 |

||||||||||

Lot Size (Multiplier) |

1 |

||||||||||

Nature of Instrument |

Secured ,Redeemable , Non-Convertible Debenture |

||||||||||

Listing |

To be listed on BSE |

||||||||||

Exchange Bid Timing( 24 hour format) |

10:00 to 17:00 |

||||||||||

*Allotment on first come first serve basis

ISSUE STRUCTURE |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Option/Series |

I |

II |

III |

IV |

V |

VI |

VII |

VIII |

|||

Nature Of NCDs |

Secured Redeemable Non-Convertible |

||||||||||

Who Can Apply |

All Categories of Investors (Category I,II,III and IV) |

||||||||||

Tenor |

36 Months |

60 Months |

120 Months |

||||||||

Interest Frequency |

Monthly |

Annual |

Cumulative |

Monthly |

Annual |

Cumulative |

Monthly |

Annual |

|||

Best Coupon Rate (% p.a.) for: |

|||||||||||

Category 1,II,III & IV |

8.75% |

9.10% |

NA |

9.15% |

9.55% |

NA |

9.30% |

9.70% |

|||

Effective Yield (% p.a.) for: |

|||||||||||

Category 1,II,III & IV |

9.10% |

9.09% |

9.10% |

9.54% |

9.54% |

9.55% |

9.70% |

9.69% |

|||

Why choose BondsIndia?

BondsIndia is an online platform for fixed-income securities such as IPOs, bonds, 54EC bonds, and fixed deposits. With a cumulative pedigree of 50+ years in the bond market, we aim to democratize the market for common investors by stationing detailed insights, expert advice, and keeping a close watch on the market sentiment. BondsIndia brings up-to-date information when IPOs go live, fixed deposits with higher interests, and bonds with competitive price before anyone else.

BondsIndia ditches the traditional ways of investing by offering a Technology based platform for investors that ensures instant online settlements and reduces counter-party risks. Choose BondsIndia for its sleek interface, fail-safe communication and step-by-step guide to ensure a well-placed bid. You can apply for India Infoline IPO on BondsIndia’s website.

Place your bid in three simple steps:

Key in Basic Details

Choose the IPO Series

Place the bid

How to invest in the Edelweiss NCD IPO?

Application process on BondsIndia platform is simple and seamless.

- Click on the details of the company on the home page

- Fill in the Application form with the basic details such as Name, email address, mobile number, Pan details, bank and Demat details

- Then, confirm the quantity and price and select payment method.

- That’s all folks , bidding complete!

Reach out to on info@bondsindia.com for more questions. Thank you for tuning in with BondsIndia.

Company Details

About the Issuer

- Edelweiss is one of India's leading financial services conglomerates, offering a robust platform to a diversified client base across domestic and global geographies.

- Key Businesses : Credit (Retail, Corporate) , Investment & Advisory (Wealth Management, Asset Management), Insurance (Life, General)

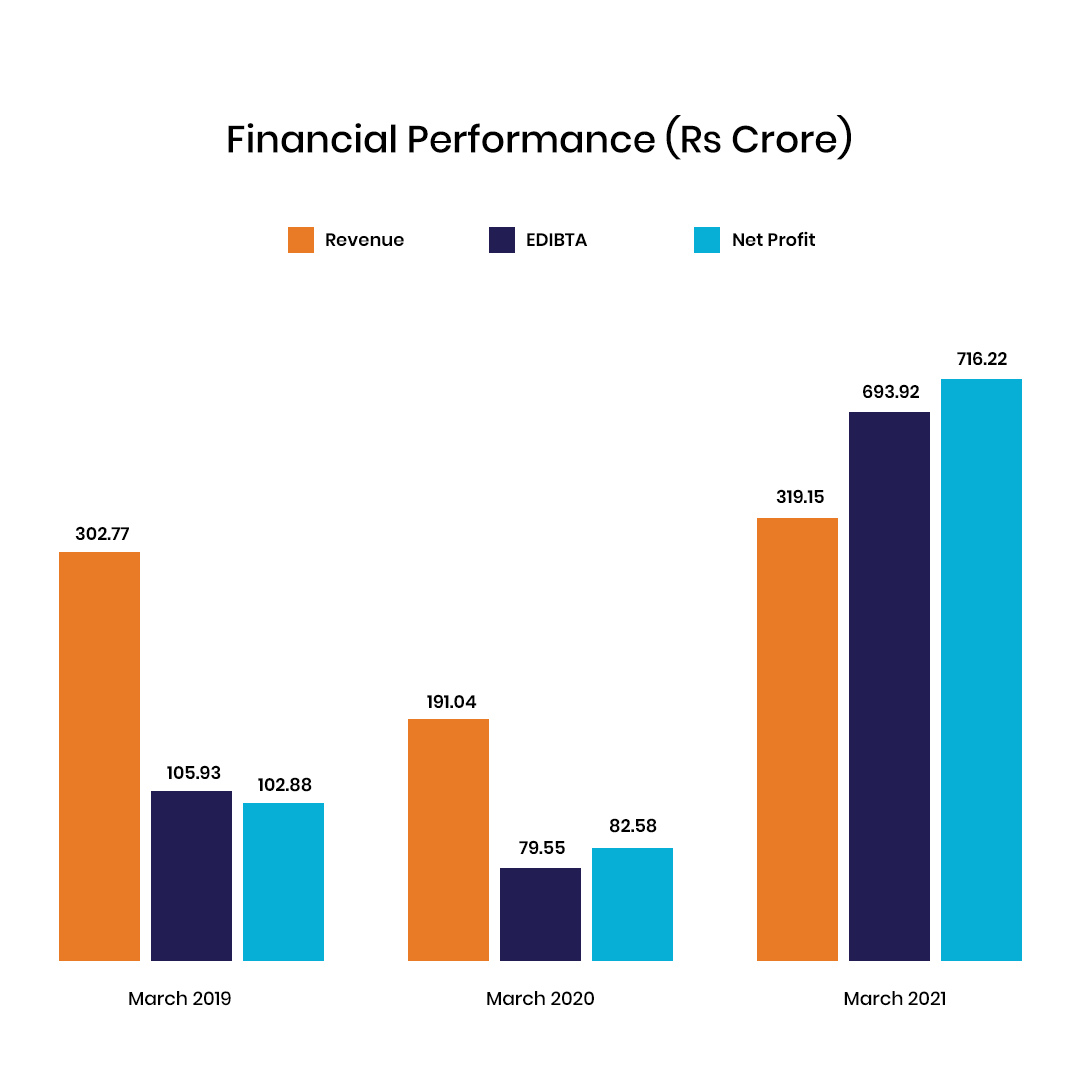

Company Financials

Key Strengths

-

Diversified business profile

The group has been diversifying within each of its key businesses, as well as entering new businesses over the past few years. It is now present in the retail and wholesale lending segments, securities broking, wealth management, asset management, insurance, stressed-asset management, and alternate assets. Many of these have now attained sizeable scale and are likely to lend greater stability to earnings

-

Demonstrated ability to build significant

competitive positions across businesses

While the group remains a large player in the traditional broking business, it has also build a sizeable lending book. In the distressed assets segment, EARC remains the largest ARC in India. The established market position in capital market-related businesses should provide the group with a regular stream of fee-based income over the medium term

Credit Risks

-

Asset quality exposed to risks related to

concentration in wholesale lending

The asset quality in the credit business has deteriorated in the last 18 months. While the asset quality in the retail loan book remained comfortable, the asset quality in the wholesale loan book deteriorated significantly

Furthermore, given the current macro environment, asset quality of the group's exposures to loans against property (LAP) and loans to micro, SME sectors would be key monitorables. This stems from the sensitivity of borrowers of such loans to the current environment

-

Lower profitability than peers

Profitability has been lower than those of other large, financial sector groups. While profitability was on an improving trend over the past few fiscals, it has been significantly impacted in fiscal 2020. With higher credit costs, return on assets (annualised) and return on equity (annualised) fell sharply to 0.5% and 3.4%, respectively, during the first 9 months of fiscal 2020 (1.6% and 12.6%, respectively, in fiscal 2019). Provisioning costs, increased by 71% year-on-year (y-o-y) to Rs 651 crore during this period.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.